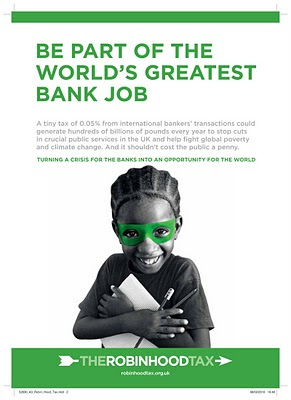

On Facebook the other day a couple of my friends had signed up for a group which called for implementation of a “Robin Hood tax”. Now judging by the slick video they produced (which features Bill Nighy of Harry Potter fame, which you can see at http://www.youtube.com/watch?v=ZzZIRMXcxRc&feature=player_embedded#), this is a UK campaign (with website http://www.robinhoodtax.co.uk//) which isn’t a big surprise given the outrage of banker bonuses has been a few notches higher than in the US. The website states that among others, supporters of such a tax include the leaders of the UK, France and Germany, Lord Turner (Chair of the UK Financial Services Authority) President Zenawi of Ethiopia, Nancy Pelosi (Speaker of the US House of Congress), Joseph Stiglitz, Jeffrey Sachs, George Soros and Warren Buffet. Not exactly lightweights, so I guess we should take this proposal seriously!!

And the bankers have. Recent newspaper reports from last week (see http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/7217200/Goldman-Sachs-faces-Robin-Hood-tax-vote-rigging-claims.html) indicate that Goldman Sachs possessed one of two computers that allegedly “spammed” the internet poll with more than 4,600 “no” votes in less than 20 minutes on Thursday. And reading through some of the comments underneath the Daily Telegraph’s article, there was lots of debate, and some obviously thought what was being proposed was the same thing as a Tobin tax. Even in today’s Financial Times (see http://www.ft.com/cms/s/0/b8e61b16-19d0-11df-af3e-00144feab49a.html) the issue just won’t go away – with one reader calling the tax hypocritical.

So what actually is being proposed here, and isn’t it similar to the Tobin tax and therefore fraught with the same types of problems that the Tobin tax would suffer from? For those that have heard of the Tobin tax and know what it is, please jump to the next para. The Tobin tax was proposed by the Yale nobel economist, James Tobin, in 1972 so as to dampen speculative foreign exchange transactions and to raise revenue for economic development. The proposal met with derision from most economists and bankers simply because it was obvious that unless we got everyone agreeing to levy this tax, then no one would levy it. Why? Because the foreign exchange market is the largest market in the world, and although it is centred on London, it could be highly mobile in terms of where the transactions were done. So if one country didn’t participate, all the business could be done in that location, thereby circumventing the tax.

This time around we have a proposal for a financial tax on all wholesale transactions. So it would cover all financial transactions, whether foreign exchange related or not, plus it would only apply to financial institutions, and not to other multinationals, say General Electric or Walmart. The logic is that it should be levied on the financial services sector as they were the ones that caused the mess that we’re in, and it would be levied at a rate of 0.05% and generate up to £200 billion.

So, what’s wrong with it? As a concept, nothing at all. As a practical way to raise money for government, though, it would be a complete disaster. Why?

First, because the assumption here is that nothing else changes - in other words what economists term as “ceteris paribus”. Of course everything would change – bankers might still work in London, but they’d move all their business accounts offshore where they’d escape the tax. Now, you might say that 0.05% is a really small tax, and you’d be right – on a £10 (roughly $15) transfer, it would come to half a penny (or roughly three fourths of a dollar), but these amounts are not what bankers deal with – try £10 million, and even that is not large for them, and you get at least £5,000, which doesn’t look quite so small, so try a few hundred of those sizes of transactions per day, and then it becomes understandable why quite a lot of business would inevitably shift offshore.

OK, so say there is a worldwide effort to introduce a similar tax elsewhere. The second reason it wouldn’t work is simply because not everyone will agree to levy such a tax. If just one country decided not to levy the tax, then a lot of business would instantly flow to that country as it would be tax exempt. All countries know this, so there is an incentive not to get involved in the tax and so benefit from all the new incoming business.

And the third and last reason it won’t work is because if it is instituted, the bankers won’t let it work. I have worked with these people and know that the last thing they want to do is to give money to the government, for whatever reason. Also they know full well that if it is seen to work, then who knows, the government might at some point in the future need more revenue, and so will raise the tax. No, better to have it fail right at the start will be the logic, so that they don’t mess with us again. So if the bankers find that indeed they are paying this tax, they will pass it on to us the consumer. If the banks end up paying it, we the consumers will end up paying higher bank charges in one way or another. In turn I don't think consumers will like that, so if the bankers make this clear to government right from the start, will any sane government introduce such a tax?

It would all make a great script for "Yes, Minister"...if the BBC comedy were still around!!

This is a blog focusing mostly on economic cycles, macroeconomics, money and finance, with an emphasis on events in the US and Europe. Also other random thoughts on things economic and non-economic. ALL COMMENTS WELCOME.

Sunday, February 14, 2010

Subscribe to:

Post Comments (Atom)

Featured Post

Free Trade on Trial - What are the Lessons for Economists?

This election season in the US there has been an extraordinary and disturbing trend at work: vilifying free trade as a "job kille...

Popular Posts

-

First, yes, I'm back again!! I now have a 18 month old baby girl, so I'm a single dad so a little limited on time these days. Neve...

-

I was at a conference recently in Tokyo, and one of the keynote speakers was Robert Engle (Nobel Prize winner in economics and Professor a...

-

This is the flag that has been carried at demonstrations lately in Athens ( - see this link if you don't believe me). It is easy to see...

No comments:

Post a Comment