Happy New Year to all my Econoblog readers, and readers through the syndication to Seeking Alpha. As usual, I will try and distill my "top down" macro views for prospects for 2018 in terms of economic growth, the stockmarket, and interest rates.

So the real question is what will perform best as we move into the late stages of the business cycle expansion, and how to hedge the uncertainty of the coming downturn whenever it is. Well there are several different approaches one can take to answering this question, so I will first do a review of what I see are the prospects for the different regions of the world, and then focus in on what I think makes sense for my own investment strategy.

A quick aside. 2017 has been an exceptional year in the stockmarkets, and the performance of the major stockmarkets in the world has been positive almost everywhere. In the US, the S&P 500 was up 19.4%, the DJIA up 25.1% and the Nasdaq up an astounding 28.2%, while the 10 year US government bond yield is still under 3%. But although the US performed well, many other countries outperformed the US. The chart below shows the return of different stockmarkets (in US$ terms), and if we use the S&P 500 as probably the best overall barometer for the entire US stockmarkets, then the US is near the bottom of the list in terms of performance for 2017.

Source: Novel Investor

But this also doesn't consider other classes of assets, and the website Novel Investor once again has this covered with a chart that shows that emerging market stockmarkets outperformed all other classes of stocks. This is due to the fact that emerging market stockmarkets have had a fairly tepid performance throughout this business cycle upswing, so in the late stages of the upswing in growth, obviously this will boost commodity prices for many things, which will allow emerging market stockmarkets to outperform.

Source: Novel Investor

Source: Novel Investor

But what of individual emerging markets? Where performed the best? Well once again, Novel investor has us covered here too.

Source: NovelInvestor.com

So Poland, China, South Korea and Hungary were the big winners for 2017. And Pakistan, which several commentators said would perform very well in 2017, was the big loser. And that really highlights a problem with emerging market economies and individual emerging markets - they are very volatile and it is really a fools game trying to pick which market will be the winner in any particular year. But there again, that's why anyone interested in investing in emerging markets would be wise to buy an emerging market mutual fund rather than stocks in any individual country.

Back to my thoughts about 2018. So with the backdrop of the current phase of the business cycle and the fact that US interest rates are likely to rise in 2018, let's look at each region in turn and then devise an economic outlook and investment position for 2018.

The US has had a great run in 2017, but with rising rates, and an erratic President, with the good news for US corporations now delivered in terms of the tax reform, further progress with President Trump's agenda will be difficult. The President will need cooperation from democrats if he is to pursue his plans to pass an infrastructure spending package, and the impasse on immigration doesn't seem to bode well for cooperation in that or in any other area for that matter. So I can only conclude that most of the good news for stocks has already now been achieved, and there will be little more coming down the pipeline. If there is more and I am wrong, then clearly the infrastructure and construction companies will do well. Given the political uncertainty in the US surrounding the mid-term elections and the ongoing investigations together with rising interest rates and withdrawal of QE, I think the US will underperform compared to other parts of the developed world and certainly with respect to the emerging markets.

The US has had a great run in 2017, but with rising rates, and an erratic President, with the good news for US corporations now delivered in terms of the tax reform, further progress with President Trump's agenda will be difficult. The President will need cooperation from democrats if he is to pursue his plans to pass an infrastructure spending package, and the impasse on immigration doesn't seem to bode well for cooperation in that or in any other area for that matter. So I can only conclude that most of the good news for stocks has already now been achieved, and there will be little more coming down the pipeline. If there is more and I am wrong, then clearly the infrastructure and construction companies will do well. Given the political uncertainty in the US surrounding the mid-term elections and the ongoing investigations together with rising interest rates and withdrawal of QE, I think the US will underperform compared to other parts of the developed world and certainly with respect to the emerging markets.

I think NAFTA will likely collapse in 2018, which will mean that Mexico is probably not a stable place to invest, but Canada will likely outperform both the US and Mexico, given that the US has made it clear that if NAFTA is terminated, then the US would still be open to falling back to the original CUFTA trade deal that was the precursor to NAFTA. So in general, I think that Canadian stocks are a safer bet than US stocks for 2018 and should be bought on any signs of weakness.

The other factor that has had very little press so far this year is that yes, we have a new Chair of the Fed, Jay Powell. As with all Fed Chairs, Jay is likely to have an early stumble or mishap in the job as he finds his feet. That may unnerve the markets as well. I would expect that maybe the FOMC might act too aggressively to increase rates than is necessary, or may "fall behind the curve" at some point. Either way, there are clearly consequences for the stockmarkets here.

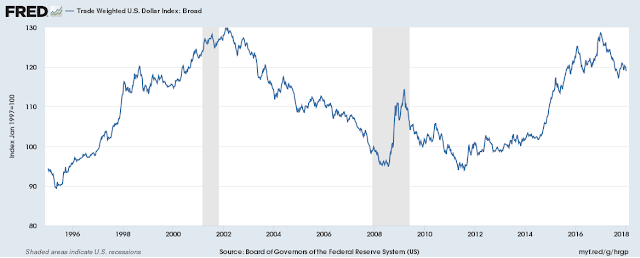

The US dollar is also a bit of a conundrum for 2018. Rising interest rates usually portend a stronger currency, and that's what we have seen so far but with the protectionism proposed by the Trump administration and the possibility that the Chinese may no longer buy so many bonds, that in turn will have an uncertain effect on the currency. As can be seen from the plot of the trade weighted US dollar, despite the recent depreciation, we are close to all time highs already. Obviously from international economics that means that the markets have already discounted further rate rises, and are perhaps now looking for reasons not to push the US currency any higher.

The two areas where there are significant risks are Brexit and Greece. With Brexit, there is no certainty yet that a trade deal between the UK and the EU will be achieved before the exit date of March 2019. Although Prime Minister Theresa May has successfully concluded the conditions of the breakup by agreeing to a hefty payment to the EU and safeguarding the right of EU nationals to remain in the UK after March 2019, this does not ensure that a trade deal will be struck in time. The current policy of "gradual divergence" (see here) does not bode well for a consensus on any new trade deal as the EU does not see this as consistent with having a trade deal that would create a level playing field between the UK and the EU - it is seen as cherry-picking the areas where the UK would not want to diverge for fear of losing business, while having the right to diverge in other areas. Also the Chancellor, Philip Hammond, who is much more in favor of a "soft" Brexit, has broached the idea of a new customs union with the EU (see here), but this would not allow the UK much independence when negotiating trade deals with other countries as the UK's hands would already be tied in relation to trade policy because of the EU customs union. The second area of risk remains Greece. Greece is now experiencing growth again, but the political situation is still not completely stable, as an elections must be called by October 2019, and the current government is unlikely to want to wait that long, so a general election is likely to be called in the second quarter of 2018. The outcome of the election is likely to determine whether Greece continues to follow the path of fiscal consolidation insisted upon the rest of the EU, or a new government pushes the country in a different direction.

From an investment standpoint probably the Nordic countries are most insulated from these risks, although probably Central and Eastern Europe stockmarkets are still likely to be the most volatile and may yet again outperform the Western and Southern European member states.

The Japanese economy therefore does appear to have achieved "escape velocity" which means that deflation is now in the rear view mirror, despite the fact that inflation is still falling short of the Bank of Japan's inflation targets. This should allow the Japanese stockmarket to make further gains in 2018. In fact, if correct, a recent FT article (see here) suggests that the labor market is now in a state of severe shortage, which should allow wages to start to rise in a more sustained. That, in turn, will boost the stockmarket.

As for India, 2017 was quite rocky (what with the monetary reforms and the unpopular new VAT tax), but as long as tinkering with major part of the macroeconomy do not continue under the Modi government, the prospects for an uptick in growth appear quite good.

The election of Cyril Ramaphosa as ANC Chair and therefore leader of the party, caused a relief rally

The election of Cyril Ramaphosa as ANC Chair and therefore leader of the party, caused a relief rally

in late 2017, and I believe this will continue through 2018, with much more business friendly approaches making an appearance in South Africa and hopefully a more pragmatic approach to achieving the lifting of all boats through more sensible economic policies for the whole economy will start to bear fruit.

But what does that mean then? I think what it means is that stocks in both China and the UK are valued at roughly half the amount that US and Japanese stocks are. That in turn tends to suggest that i) if stockmarkets globally continue to climb, it is likely that those with lower CAPEs will grow faster than those with higher CAPEs; and ii) that if there were to be a pullback, the amount of the pullback is likely to be less in both the UK and China simply because those two markets have not climbed to nearly the same levels as have both the US and Japan.

So for an investment strategy based around the viewpoint expressed here, I would suggest:

i) underweight on US and Japanese stocks

ii) overweight on UK and Chinese stocks

iii) some weight in India and European stocks

iv) underweight on US government bond holdings

v) overweight on foreign bonds, particularly of those countries where China might want to substitute holdings.

vi) overweight on other EM stocks, as these countries try to catch up with the phenomenal pick up in the US stockmarket.

And yes, I have already rearranged my own portfolio to put my proverbial money where my mouth is!

Backdrop

As we enter the 10th year since the last downturn, the global economy is living on borrowed time - and I mean that literally! As I explored in my last Econoblog posting (see here), the business cycle is elongating, for either temporary or permanent reasons. My own predilection is for a permanent elongation (mostly due to the findings from my own academic research agenda), but either way, an elongation is now occurring for this phase of the business cycle as we move into 2018.So the real question is what will perform best as we move into the late stages of the business cycle expansion, and how to hedge the uncertainty of the coming downturn whenever it is. Well there are several different approaches one can take to answering this question, so I will first do a review of what I see are the prospects for the different regions of the world, and then focus in on what I think makes sense for my own investment strategy.

A quick aside. 2017 has been an exceptional year in the stockmarkets, and the performance of the major stockmarkets in the world has been positive almost everywhere. In the US, the S&P 500 was up 19.4%, the DJIA up 25.1% and the Nasdaq up an astounding 28.2%, while the 10 year US government bond yield is still under 3%. But although the US performed well, many other countries outperformed the US. The chart below shows the return of different stockmarkets (in US$ terms), and if we use the S&P 500 as probably the best overall barometer for the entire US stockmarkets, then the US is near the bottom of the list in terms of performance for 2017.

Source: Novel Investor

But this also doesn't consider other classes of assets, and the website Novel Investor once again has this covered with a chart that shows that emerging market stockmarkets outperformed all other classes of stocks. This is due to the fact that emerging market stockmarkets have had a fairly tepid performance throughout this business cycle upswing, so in the late stages of the upswing in growth, obviously this will boost commodity prices for many things, which will allow emerging market stockmarkets to outperform.

Source: Novel Investor

Source: Novel Investor

But what of individual emerging markets? Where performed the best? Well once again, Novel investor has us covered here too.

Source: NovelInvestor.com

So Poland, China, South Korea and Hungary were the big winners for 2017. And Pakistan, which several commentators said would perform very well in 2017, was the big loser. And that really highlights a problem with emerging market economies and individual emerging markets - they are very volatile and it is really a fools game trying to pick which market will be the winner in any particular year. But there again, that's why anyone interested in investing in emerging markets would be wise to buy an emerging market mutual fund rather than stocks in any individual country.

Back to my thoughts about 2018. So with the backdrop of the current phase of the business cycle and the fact that US interest rates are likely to rise in 2018, let's look at each region in turn and then devise an economic outlook and investment position for 2018.

North America

The US has had a great run in 2017, but with rising rates, and an erratic President, with the good news for US corporations now delivered in terms of the tax reform, further progress with President Trump's agenda will be difficult. The President will need cooperation from democrats if he is to pursue his plans to pass an infrastructure spending package, and the impasse on immigration doesn't seem to bode well for cooperation in that or in any other area for that matter. So I can only conclude that most of the good news for stocks has already now been achieved, and there will be little more coming down the pipeline. If there is more and I am wrong, then clearly the infrastructure and construction companies will do well. Given the political uncertainty in the US surrounding the mid-term elections and the ongoing investigations together with rising interest rates and withdrawal of QE, I think the US will underperform compared to other parts of the developed world and certainly with respect to the emerging markets.

The US has had a great run in 2017, but with rising rates, and an erratic President, with the good news for US corporations now delivered in terms of the tax reform, further progress with President Trump's agenda will be difficult. The President will need cooperation from democrats if he is to pursue his plans to pass an infrastructure spending package, and the impasse on immigration doesn't seem to bode well for cooperation in that or in any other area for that matter. So I can only conclude that most of the good news for stocks has already now been achieved, and there will be little more coming down the pipeline. If there is more and I am wrong, then clearly the infrastructure and construction companies will do well. Given the political uncertainty in the US surrounding the mid-term elections and the ongoing investigations together with rising interest rates and withdrawal of QE, I think the US will underperform compared to other parts of the developed world and certainly with respect to the emerging markets.I think NAFTA will likely collapse in 2018, which will mean that Mexico is probably not a stable place to invest, but Canada will likely outperform both the US and Mexico, given that the US has made it clear that if NAFTA is terminated, then the US would still be open to falling back to the original CUFTA trade deal that was the precursor to NAFTA. So in general, I think that Canadian stocks are a safer bet than US stocks for 2018 and should be bought on any signs of weakness.

The other factor that has had very little press so far this year is that yes, we have a new Chair of the Fed, Jay Powell. As with all Fed Chairs, Jay is likely to have an early stumble or mishap in the job as he finds his feet. That may unnerve the markets as well. I would expect that maybe the FOMC might act too aggressively to increase rates than is necessary, or may "fall behind the curve" at some point. Either way, there are clearly consequences for the stockmarkets here.

The US dollar is also a bit of a conundrum for 2018. Rising interest rates usually portend a stronger currency, and that's what we have seen so far but with the protectionism proposed by the Trump administration and the possibility that the Chinese may no longer buy so many bonds, that in turn will have an uncertain effect on the currency. As can be seen from the plot of the trade weighted US dollar, despite the recent depreciation, we are close to all time highs already. Obviously from international economics that means that the markets have already discounted further rate rises, and are perhaps now looking for reasons not to push the US currency any higher.

Europe

European stockmarkets generally had a great year in 2017, and as QE continues in 2018, it is likely that this will continue at least until the second half of the year. If you look at the performance of the European stockmarkets in recent years, they nearly all had downturns in 2014 and/or 2015, so they are basically still catching up with the US, and of course the banking sectors in the EU are still fragile but improving as time goes on. The Mifid2 directive, which was supposed to come into force at the beginning of this year will likely (when implemented in March) increase transparency and efficiency in EU stockmarkets which will tend to increase confidence and spur greater stockmarket returns.The two areas where there are significant risks are Brexit and Greece. With Brexit, there is no certainty yet that a trade deal between the UK and the EU will be achieved before the exit date of March 2019. Although Prime Minister Theresa May has successfully concluded the conditions of the breakup by agreeing to a hefty payment to the EU and safeguarding the right of EU nationals to remain in the UK after March 2019, this does not ensure that a trade deal will be struck in time. The current policy of "gradual divergence" (see here) does not bode well for a consensus on any new trade deal as the EU does not see this as consistent with having a trade deal that would create a level playing field between the UK and the EU - it is seen as cherry-picking the areas where the UK would not want to diverge for fear of losing business, while having the right to diverge in other areas. Also the Chancellor, Philip Hammond, who is much more in favor of a "soft" Brexit, has broached the idea of a new customs union with the EU (see here), but this would not allow the UK much independence when negotiating trade deals with other countries as the UK's hands would already be tied in relation to trade policy because of the EU customs union. The second area of risk remains Greece. Greece is now experiencing growth again, but the political situation is still not completely stable, as an elections must be called by October 2019, and the current government is unlikely to want to wait that long, so a general election is likely to be called in the second quarter of 2018. The outcome of the election is likely to determine whether Greece continues to follow the path of fiscal consolidation insisted upon the rest of the EU, or a new government pushes the country in a different direction.

From an investment standpoint probably the Nordic countries are most insulated from these risks, although probably Central and Eastern Europe stockmarkets are still likely to be the most volatile and may yet again outperform the Western and Southern European member states.

Japan

The news from Japan has basically been good in 2017. The efforts to stimulate the economy using QE appear to be now paying off, with economic growth now positive for the 7th consecutive quarter (see here), but mostly due to external factors rather than domestic growth ( - consumption was still in decline in the last quarter reported). Nevertheless recent revisions to 3rd quarter GDP suggest that the economy was growing faster than previously thought, which allowed the stockmarket to remain buoyant, but it does mean that without the external demand stimulus and the continuing QE, the economy would likely have experienced only tepid growth.The Japanese economy therefore does appear to have achieved "escape velocity" which means that deflation is now in the rear view mirror, despite the fact that inflation is still falling short of the Bank of Japan's inflation targets. This should allow the Japanese stockmarket to make further gains in 2018. In fact, if correct, a recent FT article (see here) suggests that the labor market is now in a state of severe shortage, which should allow wages to start to rise in a more sustained. That, in turn, will boost the stockmarket.

Rest of Asia

My views on China are relatively well known after my recent presentation on OBOR (One Belt One Road). But to recap, I think that China will grow in 2018, but substantially less rapidly than it did in 2017 as OBOR projects take production out of the country ( - remember that GDP only includes production within the borders of a country). OBOR is clearly long term geopolitical and economic investment project, so it is expected that GDP would slow...GNP, on the other hand, will stay relatively robust. Anyone who has been to China can attest to the fact that although investment is still high, it is clearly slowing as there is now a substantial amount of "infrastructure slack" in the economy ( - visible in terms of "ghost" trade and logistics inland ports, empty buildings and relatively empty new highways and fast speed trains out in the rural west). And although consumption is now clearly on display in the major cities, I think that China's next push must be to modernize it's agricultural sector based in the rural areas, and that will not be easy.As for India, 2017 was quite rocky (what with the monetary reforms and the unpopular new VAT tax), but as long as tinkering with major part of the macroeconomy do not continue under the Modi government, the prospects for an uptick in growth appear quite good.

Africa

The election of Cyril Ramaphosa as ANC Chair and therefore leader of the party, caused a relief rally

The election of Cyril Ramaphosa as ANC Chair and therefore leader of the party, caused a relief rallyin late 2017, and I believe this will continue through 2018, with much more business friendly approaches making an appearance in South Africa and hopefully a more pragmatic approach to achieving the lifting of all boats through more sensible economic policies for the whole economy will start to bear fruit.

Investment Strategy

So given my macroeconomic views detailed above, what does this imply about investment strategy? I have produced the cyclically adjusted price to earnings ratios (CAPE ratio) for all the countries discussed above in the figure below. The data ends in November of 2017, so although we are missing one datapoint it is clear that the US has, since early 2016, had the highest CAPE. That means that the US firms' stockmarket prices were highest compared to their earnings at this stage of the business cycle. Then comes Japan, which is not far behind. At the bottom of the CAPE rankings are UK and China, while the countries sandwiched in the middle are India and collectively the European countries. |

| Source: http://shiller.barclays.com/SM/12/en/indices/static/historic-ratios.app |

So for an investment strategy based around the viewpoint expressed here, I would suggest:

i) underweight on US and Japanese stocks

ii) overweight on UK and Chinese stocks

iii) some weight in India and European stocks

iv) underweight on US government bond holdings

v) overweight on foreign bonds, particularly of those countries where China might want to substitute holdings.

vi) overweight on other EM stocks, as these countries try to catch up with the phenomenal pick up in the US stockmarket.

And yes, I have already rearranged my own portfolio to put my proverbial money where my mouth is!