An interesting discourse about "Secular Stagnation" has broken out in the economics profession, and this seems to be quite appropriate given the replacement of Ben Bernanke by Janet Yellen as the Chairperson of the Fed, and her reputedly dovish stance on monetary policy. "Secular stagnation" is really a forgotten relic of 1930s macroeconomics (by Alvin Hansen), and has fed into similar thinking in the current state of both the US and EU economies.

But Paul Krugman in his commentary (see here) on Larry Summer's comments at an IMF conference, takes this one step further. He says that in fact bubbles in the economy are a good thing, as they keep the economy moving along, rather than sinking into stagflation and deflation as they have in Japan. But as Krugman points out, this might be due to the slowing growth in population and in the labor force participation rate in particular. This in turn reduces the equilibrium natural real rate of interest, and so current real rates are above this level and this consequently fosters below average growth. The further corrollory is that stricter financial regulation might be bad for growth as irresponsible lending is actually good for the economy and also presumably creating housing bubbles by QE is actually a good thing as it presumably puts money in people's pockets. The chart above shows that less food and energy, inflation is around 1.7 percent currently.

My problem with this entire thesis is that it is predicated on QE not being in place. QE is in place and by keeping short term interest rates near to zero, it does create negative real rates on these government rates as long as inflation is positive, which it now is. The 90 day non-financial commercial paper rate is currently 0.25 percent, which means that the core real rate calculates to around -1.5%. Obviously the danger is deflation, as this pushes real rates up creating a disincentive to invest. But in fact right now companies have a great incentive to invest, as money is still cheap and likely to become more expensive once the Fed tapers. No, the real problem is that companies and banks are sitting on a huge pile of cash - lending standards are extremely strict and so the stimulus that is supposed to be funding house purchases and small business expansion is just not at the level it should be.

No the best way to get the world economy moving forward is not really in the hands of the Fed anymore - it is in the hands of the politicians - so in my view completion of the Transatlantic Free Trade Area (TFTA), the Trans-Pacific Partnership (TPP) and also perhaps the re-starting of the Doha Round of the GATT/WTO talks will lead to an upswing in growth in 2015 and beyond if these agreements are concluded. These agreements will boost world trade and although yes, they are likely to depress prices for traded goods, they will lead to greater quantities of goods being traded between the major trading blocs leading to a one-time stimulus for all economies. Plus the wealth effect from the US stockmarket right now will hopefully continue as more bystanders are convinced that the return on stocks far exceeds that of interest bearing deposits, so this should support US consumption and investment going forward.

And this brings us round to the Yellen Put. Yellen clearly is going to follow in the footsteps of Bernanke, so the support underlying the stockmarket and the financial sector should continue into 2014, but as long as no further government shutdowns are likely, the taper should start in 2014. As I have stated in previous blog postings the taper will likely start on just the purchases of government paper, given that government really doesn't need this support anymore and continue to stimulate the housing recovery.

As I believe in the persistence of economic cycles, it is not unlikely that we will have a downturn anytime from 2015 onwards, so getting the Fed to move away from an extremely expansionary stance is now taking on some urgency, otherwise it will have limited ammunition to fend off another economic downturn. But this is also where the completion of these Free Trade deals is extremely important, as their completion should delay any future downturn beyond 2015 through to 2016 or beyond.

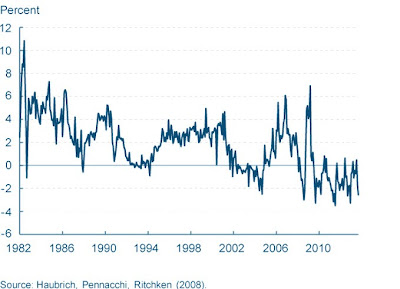

So first, what is "secular stagnation"? As Gavyn Davies points out in his excellent FT piece, it is a situation where after a financial crisis, as nominal interest rates remain close to zero, deflation causes real interest rates to go negative ( - recall that real interest rates are nominal interest rates minus inflation). In other words, if you borrow money, the gain in its value due to deflation outstrips the low nominal interest rate, meaning in real terms it's actually costing you quite a bit. The problem originates from the fact that although inflation can be negative ( - and is termed deflation), nominal interest rates cannot (under normal circumstances) go negative. This means that real interest interest rates remain above where they should be ( - the equilibrium rate being the Wicksellian "natural" interest rate), so that chronic underinvestment occurs and the economy crawls along at much lower growth rate than it should do, with in fact a widening of the output gap even though the economy is no longer in recession.

|

| Source: Board of Governors: Federal Reserve System |

But Paul Krugman in his commentary (see here) on Larry Summer's comments at an IMF conference, takes this one step further. He says that in fact bubbles in the economy are a good thing, as they keep the economy moving along, rather than sinking into stagflation and deflation as they have in Japan. But as Krugman points out, this might be due to the slowing growth in population and in the labor force participation rate in particular. This in turn reduces the equilibrium natural real rate of interest, and so current real rates are above this level and this consequently fosters below average growth. The further corrollory is that stricter financial regulation might be bad for growth as irresponsible lending is actually good for the economy and also presumably creating housing bubbles by QE is actually a good thing as it presumably puts money in people's pockets. The chart above shows that less food and energy, inflation is around 1.7 percent currently.

My problem with this entire thesis is that it is predicated on QE not being in place. QE is in place and by keeping short term interest rates near to zero, it does create negative real rates on these government rates as long as inflation is positive, which it now is. The 90 day non-financial commercial paper rate is currently 0.25 percent, which means that the core real rate calculates to around -1.5%. Obviously the danger is deflation, as this pushes real rates up creating a disincentive to invest. But in fact right now companies have a great incentive to invest, as money is still cheap and likely to become more expensive once the Fed tapers. No, the real problem is that companies and banks are sitting on a huge pile of cash - lending standards are extremely strict and so the stimulus that is supposed to be funding house purchases and small business expansion is just not at the level it should be.

No the best way to get the world economy moving forward is not really in the hands of the Fed anymore - it is in the hands of the politicians - so in my view completion of the Transatlantic Free Trade Area (TFTA), the Trans-Pacific Partnership (TPP) and also perhaps the re-starting of the Doha Round of the GATT/WTO talks will lead to an upswing in growth in 2015 and beyond if these agreements are concluded. These agreements will boost world trade and although yes, they are likely to depress prices for traded goods, they will lead to greater quantities of goods being traded between the major trading blocs leading to a one-time stimulus for all economies. Plus the wealth effect from the US stockmarket right now will hopefully continue as more bystanders are convinced that the return on stocks far exceeds that of interest bearing deposits, so this should support US consumption and investment going forward.

And this brings us round to the Yellen Put. Yellen clearly is going to follow in the footsteps of Bernanke, so the support underlying the stockmarket and the financial sector should continue into 2014, but as long as no further government shutdowns are likely, the taper should start in 2014. As I have stated in previous blog postings the taper will likely start on just the purchases of government paper, given that government really doesn't need this support anymore and continue to stimulate the housing recovery.

As I believe in the persistence of economic cycles, it is not unlikely that we will have a downturn anytime from 2015 onwards, so getting the Fed to move away from an extremely expansionary stance is now taking on some urgency, otherwise it will have limited ammunition to fend off another economic downturn. But this is also where the completion of these Free Trade deals is extremely important, as their completion should delay any future downturn beyond 2015 through to 2016 or beyond.