|

| (Source: ThinkStock photos) |

Hopefully that can change in 2017. And 2017 will clearly be a pivotal year for the US, as a new administration takes the reins with likely a very different course to be charted, and with likely quite different results. As an entrepreneur, President-elect Donald Trump has largely kept his views on fiscal and monetary policy to himself, and even in the election he mostly focused on what he would do to change trade policy, which for a country like the US, with only around a 15% dependency on foreign trade, is not going to have that much of an effect. Of course changes in trade policy will have an effect on the US's other NAFTA partners, the T-TIP and the TPP, the former likely negatively affecting Mexico and Canada, and the latter 2 now dead on arrival. The TPP is the only new transcontinental trade agreement that could be saved, but it would not be as influential without the US being part of the agreement - on the other hand T-TIP is clearly dead. In a way it is just as well that Canada recently signed the new CETA deal (see here), which will allow Canada to partially offset any negative impact arising from any renegotiation of what President-elect Trump has called "one of the worst trade deals the US has ever signed". This in addition to the so-called "Thucydides Trap", where a rising power (China) begins to challenge the hegemony of the existing power (the US) would point to trade war with China, which some commentators (such as Paul Krugman (see here)) think will soon occur. But more on this "Thucydides Trap" in a future blog.

|

| NYE 2016 in Dubai |

But what are the other effects of the tariffs that President-elect Trump has threatened (and presumably will have to go ahead with if he really stands any chance of a second term in the White House)? As any student of international economics will tell you, the first implication is that domestic prices will rise for those goods that are protected from international competition. So these rising prices will lead to a boost in US inflation, which although not substantial, will have other effects.

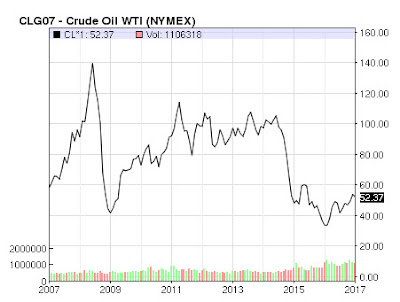

To understand US domestic price pressures, we must also include the prospects for oil in our discussion here. Oil prices have been on an upward trajectory lately, and are headed for $60 per barrel based on increased demand for oil with the lower prices as well as more robust demand as we head into the final expansionary growth phase of the international business cycle. There is also a reinforcement effect going on here as well, as higher oil prices means more fracking, which means increased output and wages in the US, which further adds to price pressures. So it is likely that US inflation pressures will finally start to build.

|

| Source: Bloomberg.com |

Sectors that will benefit from this are the financial and construction sectors in the US. There are considerable uncertainties surrounding the healthcare and biotech sectors though, The financial sector will continue to do well as US banks are in much better shape than their counterparts elsewhere and will also benefit from higher interest rates, and the latter because the millennials will finally start to inherit wealth and get sufficient pay raises to afford their own properties. More on this in a future blog I am preparing.

Let's now turn our attention to Europe. The main problems here are i) the political and economic fallout from Brexit; ii) the continuing migration problem; and iii) continued weakness of the financial sector. On the first problem, I have another blog coming out tomorrow on this topic, so I won't steal my own thunder, but essentially this will create uncertainty and therefore some economic and financial wobbles this year in the markets. The interactions between the UK and EU negotiating teams on Brexit will inevitably leak and cause considerable volatility, particularly in the UK. I do not foresee other member states following the UK though, as the deal they will likely strike will be tailored specifically to the UK, and the EU will make sure that it is not attractive to other member states, to facilitate cohesion after Brexit. On the second issue, the migrant problem: this will cause some political problems in Germany, but will also provide significant labor needed to ensure that German labor supply expansion supports economic growth, but the political backlash in both France and Germany may cause more business friendly governments to be elected in those key member states, which are the engines behind the EU, so this might actually not be a bad thing for economic growth (although it might not be so good for political cohesion). And the third issue, that of the EU financial sector will start to be resolved in 2017 as a more concerned ECB and the EU Banking Authorities take action to ensure the capital adequacy of the European banks.

|

| Source: IMF IFS and authors calculations |

So what does all this mean for European growth and stockmarket prospects in 2017. The chart above gives us some clues. The chart shows that even with the 3.5% annualized rate of growth reported in the 3rd quarter in the US, the rate of growth for the US will still be below that of the EU. But Trump's election has changed this equation completely, with the US likely to leapfrog over the EU in the 2017. That points to outperformance for the US over the EU stockmarkets in 2017, although there still could be some bright spots in the EU, notably once again the banking sector and also the energy sector, depending on where the price of oil goes.

|

| Source: Yahoo Finance |

Let's now turn to Japan. Despite the effots of the Abe government, the Japanese economy still in dangerously close to turning deflationary again, as can be clearly seen from the chart on GDP growth. This is on top of the exceptional fiscal and monetary stimulus that has already been delivered under Abenomics. The stockmarket performance of the Japanese Nikkei reflects the reflationary policies adopted since 2012, but the Nikkei is still not performing as well as the US and German stockmarkets. This can be clearly seen in the stockmarket chart above, which sets the end of 1990 as the base year to show longer term stockmarket returns.

This stockmarket chart is informative as it indicates that in fact on returns basis the DAX (German stockmarket) has given a slightly better return than the S&P500 since 1991, which is not what I would expect, especially when taken in nominal terms. Nevertheless, the return from the stockmarket over these 26 years has been remarkable, with a 7 fold increase in stockmarket value, and this doesn't even include the total return (return including dividends). Investment in Japan (represented by the Nikkei) has clearly not given a good return (in fact it is still negative), and this reflects Japan's "lost 2 decades" of economic growth and deflation.

So what of other economies and stockmarkets? My own view is that China is now a riskier bet (given the prospect of a trade war with the US), and so should be avoided. India, on the other hand, still has good prospects, although the Modi reforms appear to have stalled, which may put the brakes on the good economic growth performance (currently higher than China's) that the country has recently experienced.

For other regions, Australia and New Zealand have performed very well recently, but now appear to be running into some inflationary concerns, and Africa also still has considerable unlocked potential, but does not appear to have gotten past it's political problems quite yet.