Despite the fact that the FOMC decided not to "taper" today, I believe that it missed an opportunity to inject less funds into the market and begin the process of exiting from QE3. Part of the reason that the Fed decided not to "taper" this month is that there are considerable uncertainties regarding US fiscal policy and whether the labor market improvements will be sustained at current levels through into next year.

In today's FT (see here), Robin Harding outlined how he thinks the FOMC will implement the taper of monetary policy which I've been discussing in my most recent blogs. Although it will not occur now, I think it is instructive as a dynamic "exit strategy" from QE3. So this is my (edited) response ( - posted as a response earlier today after Harding's article) in the comments section of the FT:

In today's FT (see here), Robin Harding outlined how he thinks the FOMC will implement the taper of monetary policy which I've been discussing in my most recent blogs. Although it will not occur now, I think it is instructive as a dynamic "exit strategy" from QE3. So this is my (edited) response ( - posted as a response earlier today after Harding's article) in the comments section of the FT:

"The taper is largely misunderstood, but it clearly needs to

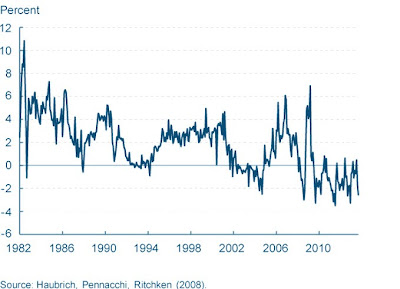

happen sooner rather than later in my opinion, as I believe that inflation

expectations have now bottommed, and are on the rise again. The taper though is a dynamic animal, and

although Harding is right in assuming that the FOMC will rightly err on

tapering Treasury purchases at a faster rate than MBSs, the static scenario he

sets up likely will not be enough "forward guidance" on what the Fed

has planned for the rollback. If they do not give some guidance on the taper going forward then every FOMC meeting from now on is going to be a financial media circus and lead to a lot of uncertainty. And I make

this statement knowing that Bernanke will likely want to put in place a dynamic

policy that anchors expectations about Fed actions going forward, but that can

be modified as needs dictate.

Harding asks, for example, "if a taper were 100%

Treasuries, then does that communicate no reduction in MBS purchases until

Treasuries are reduced to zero? Or just no reduction in MBS with the first

tapering move – in which case how does the Fed make that clear?"

I think that if the FOMC really deliberates on this point

they will come to the conclusion that although monetary policy should be

neutral by June 2014 - in other words, there is no "net" purchasing

occurring in June, the only way to taper and allow for transparency is to make

the rollback dynamic. That means that purchases need to be ramped back month by

month, but perhaps so that Treasury purchases reverse before June, but MBSs

reverse after June. As far as I am

aware, the Fed has been purchasing $40bn of MBS per month, and so must have

been purchasing about $45bn of Treasuries.

That implies that if the taper is proportional roughly equal amounts of

Treasuries and MBSs would not be bought.

Obviously that will have a much bigger impact on the housing market than

the Fed would like at this point in the housing recovery.

So given this, I would modify Hardings options to read:

Option 1: Bond purchases to fall by $9bn per month, and MBS

purchases to fall by $1bn per month.

That means in terms of bond purchases, this will likely reverse

purchases in about 5 months into sales, but MBS purchases would continue beyond

the June 2014 "end" date and well into 2015.

Option 2: Bond purchases to fall by about $7bn per month,

and MBS purchases to fall by around $3bn per month. This would put more onus on adjustment in the

housing market, but would nevertheless would have the Fed selling MBSs by 2015.

Option 3: Bond purchases to fall about $4.5bn per month and

MBS purchases to fall by $4bn as well.

This would have the Fed neutralize policy by June of 2014, and then

decide how much to sell going forward.

One thing I think is not known by anyone is how the Fed's

buying or selling will change the market.

Why? Because both markets are

very different beasts. The market for

Treasuries is extremely international and dominated by foreigners because of

the US's hegemonic place in the current economic world order. MBSs on the other hand might be way more

difficult to unload internationally, given the lessons of the finaniclal

crisis, and so the buyers for these will more likely come from financial

institutions based in the US. That poses

a problem for the Fed, as unloading these securities is going to require some

judgement in terms of how much help the US housing market requires. I am glad that I"m not on the FOMC making this decision today!!"